Stock Market Week 45/25: RENIXX Hits Another Yearly High - High Volatility Slows Uptrend - Canadian Solar, Vestas, Xinyi Solar, and Solaredge Post Double-Digit Gains

ünster (Germany) - The RENIXX World Index rose sharply at the beginning of last week and closed Thursday at a new yearly high. Positive corporate reports in particular lifted the index and set the tone. However, a significant correction followed on Friday, reflecting the currently high volatility in the renewable energy market. By the end of the week, the RENIXX managed to remain only slightly in positive territory.

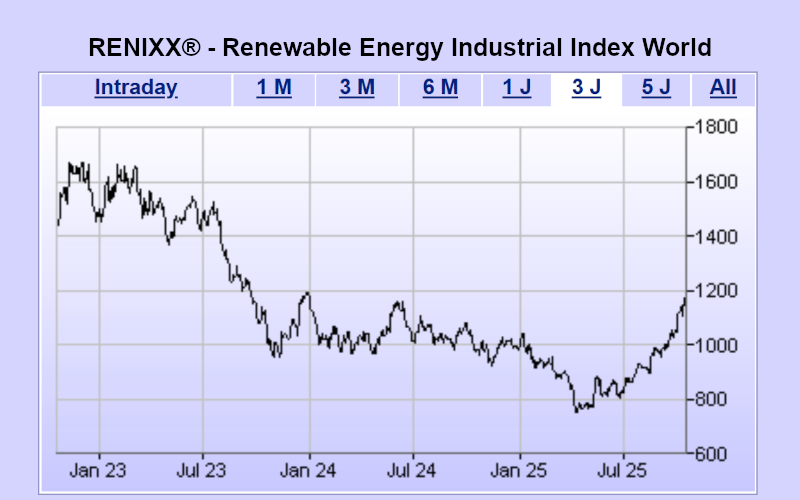

Technical Situation: RENIXX Climbs Well Above 1,200 Points

From the end of 2023 through January 2025, the RENIXX moved sideways between 1,000 and 1,200 points. The subsequent drop to 748 points marked a significant interim low. With the recent rise to well above 1,200 points, the index has now returned to the upper end of its previous trading range. After Friday’s pullback, RENIXX continues to hover around the 1,200-point mark. On a year-to-date basis (as of Friday’s close), the RENIXX is up 21.6% (previous week: 21.3%).

Corporate News from Week 45/25

Vestas rises sharply after quarterly results<(strong> Vestas impressed in Q3 with revenue up 3% and an EBIT margin of 7.8% (Q3 2024: 4.5%). The full-year 2025 forecast was slightly narrowed: previously Vestas expected revenue of €18-20 billion with an EBIT margin of 4-7%, but now forecasts €18.5-19.5 billion and a 5-6% margin. With a 14.2% gain to €20.30, Vestas was one of the top RENIXX performers last week.

Scatec ASA: special effects weigh on earnings - stock falls

Scatec reported higher Q3 revenue but a lower EBITDA, mainly due to a divestment in South Africa and a repayment obligation in the Philippines. The CEO emphasized that construction activities are progressing according to plan with solid margins, and that NOK 1 billion in debt was repaid. Gross debt now stands at around €571 million. The share price dropped 5.7% to €8.61 last week.

Array Technologies: strong growth and APA acquisition

U.S. solar tracking systems maker Array Technologies reported Q3 2025 revenue of $393.5 million (Q3 2024: $231.4 million). The acquired company APA Solar contributed $16.9 million. Adjusted EBITDA rose to $72.2 million (Q3 2024: $46.7 million), net income reached $18.4 million (Q3 2024: -$155.4 million), and adjusted EPS was $0.12 (Q3 2024: -$1.02). CEO Kevin G. Hostetler highlighted strong order inflows, operational strength, and the strategic APA acquisition. The stock temporarily rose to €7.50, but ended the week down 3.9% at €7.17.

Xpeng: autonomous vehicles and humanoid robots

At its “AI Day 2025” in Guangzhou, Xpeng presented autonomous road vehicles, flying robotaxis under the Aridge brand, and a humanoid robot. The company positions itself as a “global embodied intelligence company,” showcasing how AI and physical robotics converge in mobility. The new products are slated for mass production in 2026 and late 2026. The stock fell 4.2% to €19.35.

Green Plains: solid results despite declining revenue

U.S. ethanol producer Green Plains reported Q3 2025 revenue of $508.5 million, down 23% from $658.7 million in Q3 2024. Net income was $11.9 million or $0.17 per share (Q3 2024: $48.2 million, $0.69). Adjusted EBITDA came in at $52.6 million (Q3 2024: $53.3 million). Its nine bioethanol plants operated at 101% capacity utilization. Strategic moves, including the sale of the Obion ethanol facility in Tennessee to repay $130.7 million in debt, strengthened the balance sheet. Green Plains also continues to monetize tax and emission credits (45Z credits). The stock initially rose to €9.74, but later fell back to €8.31.

Sunrun: strong growth in solar and storage solutions

Sunrun increased Q3 2025 revenue by 35% to $724.6 million. Net profit reached $16.6 million or $0.07 per share, compared to a loss of -$83.8 million (-$0.37 per share) in the prior-year quarter. The U.S. solar and storage provider added 30,104 new customers, reaching a total of 971,805 subscribers. Installed storage capacity grew 23% to 412 MWh (Q3 2024: 336 MWh), while solar capacity rose 4% to 239 MW (Q3 2024: 230 MW). The company reaffirmed its full-year revenue and EBITDA guidance. By week’s end, the Sunrun stock was down 6.2% to €16.81, making it the weakest RENIXX performer.

RENIXX starts the first trading day with strong gains

On the first day of the new trading week, the RENIXX surged by 5.7 percent to 1,263.03 points, marking a new yearly high (closing price, November 10, 2025, Stuttgart Stock Exchange). The strongest performers were Solaredge, Daqo, Canadian Solar, Xpeng, and Array Technologies. The weakest performers included Goldwind, Plug Power, EDP Renewables, Grenergy Renovables and Verbund.

Source: IWR Online, 11 Nov 2025