Stock Market Week 03/26: RENIXX breaks 1,200 points - Ørsted: US offshore wind farm - Scatec: Africa’s largest PV & storage project - Nordex: 10 GW of orders in 2025 - Ormat: PPA for AI data centers

Münster (Germany) - Following a successful start to the new stock market year, the RENIXX continues its positive trend. In the second full trading week of the year, the RENIXX gained 4.4 percent to 1,249.23 points, clearly surpassing the 1,200-point mark. Year to date, the index is already up 10.5 percent in 2026.

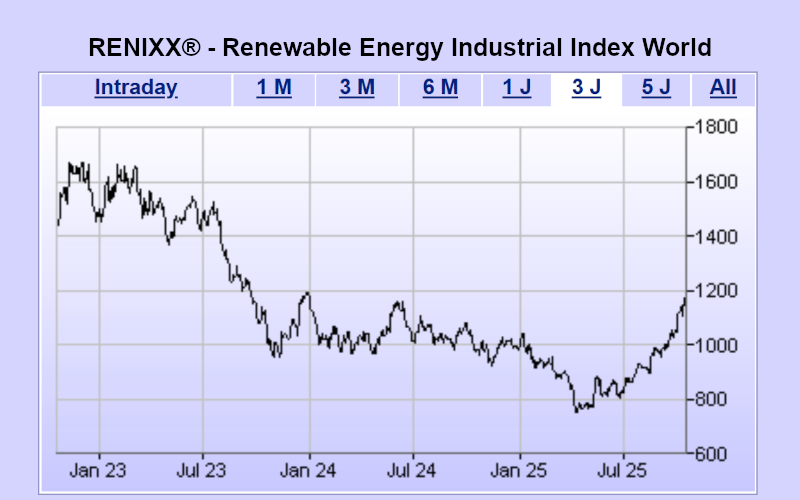

Technical outlook: RENIXX breaks above the current range between 1,000 and 1,200 points

From the end of 2023 to early January 2025, the RENIXX moved within a pronounced sideways range between 1,000 and 1,200 points. The subsequent decline to 748 points in 2025 marked a significant interim low and an important turning point. This level remains the key support zone in the longer-term chart.

Amid rising volatility, the index temporarily advanced to just under 1,300 points, once again reaching the upper boundary of the former trading range. Profit-taking then led to a sharp correction, at times down close to the 1,000-point mark. After a subsequent rebound, a neutral sideways phase currently dominates, albeit with a slightly positive bias.

This week saw a first successful breakout attempt above the 1,200-point level. If the RENIXX can hold this level, the next hurdle at 1,300 points comes into focus.

Company news week 03/26

Ørsted offshore wind farm: Trump administration suffers second defeat in federal court

On January 12, 2026, the US District Court for the District of Columbia overturned the suspension order issued on December 22, 2025 by the Bureau of Ocean Energy Management (BOEM) of the US Department of the Interior for the Revolution Wind offshore wind farm. This means the legal tug-of-war continues. BOEM had already unexpectedly halted construction on August 22, 2025, allegedly for national security reasons. In fact, the project had already been fully approved in 2023 with the issuance of the Record of Decision (ROD), including the results of military reviews. The share price gained 2.7 percent over the past week to EUR 17.97.

Nordex continues growth trajectory in 2025 - more than 10,000 MW of orders worldwide

The Nordex Group continues its growth path and closes the 2025 financial year with a new record. In the fourth quarter of 2025, the company received orders totaling 3,600 MW. This brings total order intake for the year to 10,200 MW (10.2 GW), exceeding the previous year’s record by 22.5 percent. On a weekly basis, Nordex shares slipped slightly by 1.2 percent to EUR 31.88.

Ormat signs long-term power purchase agreement for AI data centers

The growing number of new AI data centers is significantly increasing electricity demand in the United States. Geothermal specialist Ormat Technologies is entering this market and has signed its first direct power supply contract with a data center operator.

The power purchase agreement (PPA) with US data center operator Switch secures the supply of around 13 megawatts of power from the Salt Wells geothermal power plant in the state of Nevada. Ormat plans to conclude additional power supply contracts under this model in the future. Ormat shares rose 2.8 percent to EUR 101.80.

RENIXX starts the week in negative territory

At the start of the new trading week, the RENIXX is down around 1.5 percent by midday to 1,230 points. Stocks posting losses include Sunrun, Bloom Energy, Cadeler, Vestas, Plug Power, SolarEdge and Ballard Power. Slight gains are seen in Goldwind, China Longyuan, Nordex, BYD, Xinji Solar and Meridian Energy.

About the global stock index RENIXX World

The RENIXX® World (Renewable Energy Industrial Index, ISIN: DE000RENX014) is the world’s first stock index for renewable energies and the oldest global stock market barometer for this industrial future sector. It covers wind energy, solar energy, bioenergy, geothermal energy, hydropower, electromobility, hydrogen and fuel cells.

The index comprises 30 international companies with the highest free-float market capitalization and reflects both the performance and the global market development of the renewable energy industry.

The RENIXX was launched on May 1, 2006 with a base value of 1,000 points; a back-calculation to 2002 has been carried out. The index is available via leading financial media and data providers such as Bloomberg, Reuters, Financial Times, BlackRock (Aladdin) and Wallstreet Online.

Source: IWR Online, 20 Jan 2026