Stock Market Week 04/26: RENIXX Firmly Above 1,200 Points - Enphase and Goldwind Post Double-Digit Gains - Ormat Takes Stake in Sage Geosystems - Ørsted Nears Completion of Mega Project in Taiwan

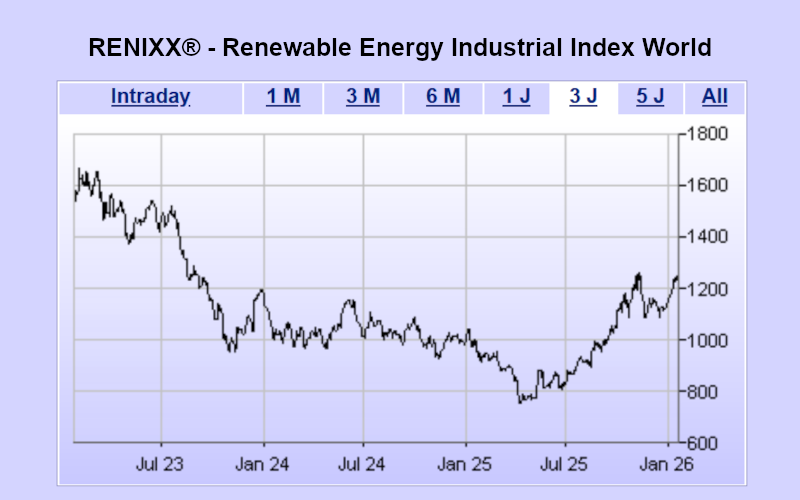

Münster (Germany) - After the strong rise in the first trading weeks of the year, the RENIXX remained stable above the 1,200-point mark last week. Compared to the previous week, the index closed almost unchanged.

Technical outlook: RENIXX establishes itself above 1,200 points

From the end of 2023 to early January 2025, the RENIXX traded sideways in a range between 1,000 and 1,200 points. The drop to 748 points in 2025 marked a significant interim low and an important turning point, which now serves as a key support zone. Since that low, the RENIXX has already climbed to 1,244 points, gaining around 66.5 percent. With rising volatility, the index temporarily advanced to nearly 1,300 points, once again reaching the upper boundary of the former trading range. Profit-taking subsequently pushed it back toward the 1,000-point level. After a subsequent rebound, the index is now showing a neutral sideways phase with a positive bias. Last week, the RENIXX closed above the 1,200-point mark. If the index can hold this level, the next hurdle at 1,300 points comes into focus, making a further dynamic upswing appear possible. On a year-to-date basis in 2026, the RENIXX remains up 10.5 percent after Friday’s close.

Company news week 04/26

Ormat invests USD 25 million in Sage Geosystems - pressure geothermal technology set to enter pilot phase

Ormat has announced an equity investment of USD 25 million in Sage Geosystems. Sage plans to test its pressure geothermal technology at an existing Ormat power plant. The company aims to extract heat from hot, dry rock while simultaneously testing a pressure-based energy storage system. If the pilot project is successful, Ormat will have the option to develop projects based on this pressure geothermal technology. In addition, Ormat has been awarded the Telaga Ranu geothermal area. In the planning documents of the state-owned utility PT PLN (RUPTL), the area is identified as having potential of up to 40 MW of baseload-capable geothermal capacity. Development through the end of 2030 is intended to replace diesel-based power generation and strengthen energy security in the region. By the end of the week, Ormat shares were up 2.3 percent at EUR 104.10.

Ørsted in Taiwan on the home stretch - all turbines installed at the Greater Changhua 2b and 4 offshore wind farm complex

Ørsted has completed the installation of all 66 wind turbines at the Greater Changhua 2b/4 offshore wind farm in Taiwan. This marks the end of the construction phase of the 920 MW project, one of the largest offshore wind developments in the Asia-Pacific region and a key component of the energy transition there. The 14 MW SG-14-236 turbines from Siemens Gamesa were installed within a single construction season—despite challenging weather conditions in the Taiwan Strait. The project makes large-scale use of pile-free suction bucket jacket foundations for the first time and sets new benchmarks with 115-meter-long rotor blades. Ørsted shares rose 1.3 percent to EUR 18.21.

U.S. Patent and Trademark Office rejects challenges against First Solar’s TOPCon patents

First Solar has scored a win in a patent dispute. The U.S. Patent and Trademark Office (USPTO) has rejected three Inter Partes Review (IPR) petitions filed against First Solar’s patents. The petitions were submitted by Jinkosolar, Mundra Solar, and Canadian Solar, seeking to challenge the validity of TOPCon patents held by the U.S. manufacturer. Jinkosolar and Canadian Solar sought to invalidate U.S. Patent No. 9,130,074, while Mundra Solar challenged U.S. Patent No. 9,666,732. Both patents relate to manufacturing processes for TOPCon crystalline silicon photovoltaic cells. At the same time, First Solar has filed lawsuits in the U.S. alleging patent infringement. These cases are pending before the District Court for the District of Delaware. First Solar shares fell 2.4 percent last week to EUR 204.95.

Jinkosolar subsidiary deep in the red in 2025

Jinkosolar’s operating subsidiary Jinko Solar Co., Ltd. (Jiangxi Jinko), in which JinkoSolar holds approximately 55.59%, has published preliminary, unaudited financial figures for 2025. The company expects a net loss attributable to shareholders of between RMB -5.9 billion and RMB -6.9 billion (approx. EUR -722 million to -845 million). Excluding extraordinary gains and losses, Jinkosolar anticipates an even higher adjusted net loss of between RMB -6.7 billion and RMB -7.8 billion (approx. EUR -820 million to -954 million). Jinkosolar notes that these preliminary figures relate exclusively to Jiangxi Jinko and were prepared in accordance with accounting standards of the People’s Republic of China (PRC GAAP). JinkoSolar shares fell 8 percent last week to EUR 23.45.

RENIXX slightly weaker at the start of the week

At the start of the new trading week, the RENIXX edged slightly lower. The day’s winners were the two wind energy stocks Vestas and Ørsted, followed by Array Technologies, Nordex, and Sunrun. The biggest losses were recorded by Plug Power, Goldwind, Xinyi Solar, Bloom Energy, and Ballard Power.

About the global stock index RENIXX World

The RENIXX® World (Renewable Energy Industrial Index, ISIN: DE000RENX014) is the world’s first stock index for renewable energies and the oldest global stock market benchmark for this industrial future sector. It covers wind energy, solar energy, bioenergy, geothermal energy, hydropower, electromobility, hydrogen, and fuel cells. The index comprises 30 international companies with the highest free-float market capitalization and reflects both the performance and the global market development of the renewable energy industry. The RENIXX was launched on May 1, 2006, with a base value of 1,000 points; historical back-calculation has been conducted back to 2002. The index is available via leading financial media and data providers such as Bloomberg, Reuters, Financial Times, BlackRock (Aladdin), and Wallstreet Online.

Source: IWR Online, 27 Jan 2026