Stock Market Week 06/26: RENIXX Declines - Enphase Jumps More Than 35 Percent - Ørsted: Strategic Realignment - Nordex Shares Reach New Annual High - Goldwind: EU Probes Potential Distortion of Competition

Münster (Germany) - The RENIXX declined last week and closed again below the 1,200-point mark. Weekly volatility among individual stocks remains high. At present, the RENIXX is being driven less by geopolitical issues and more by company-specific results.

Technical Situation: RENIXX Continues Sideways Movement with Slightly Positive Bias

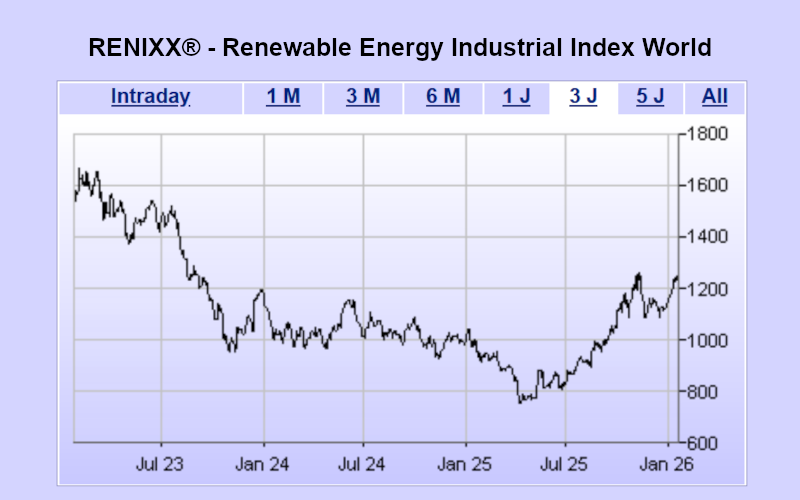

From late 2023 to early January 2025, the RENIXX traded in a sideways range between 1,000 and 1,200 points. The pronounced interim low of 748 points in 2025 marked an important turning point and has since formed a key support zone.

Since that low, the index has recovered steadily and reached a yearly high of 1,279.06 points in recent weeks, corresponding to the upper boundary of the former trading range. As the RENIXX was unable to sustainably break above this level, it has now returned to a neutral sideways phase. The overall trend remains slightly positive, with the central support zone around 1,000 to 1,100 points continuing to act as a stabilizing anchor. On a year-to-date basis in 2026, the RENIXX is up 5.8 percent based on Friday’s closing price.

Company News Week 06/26

Enphase: Revenue and Profit Down in Q4 2025 - Full Year 2025 Shows Growth

Enphase shares surged strongly following the release of earnings. For Q4 2025, Enphase reported declines in revenue and earnings compared with both the previous quarter and the same quarter of the prior year. On a full-year basis, Enphase Energy increased both revenue and profit compared with fiscal year 2024. For the first quarter of 2026, the company expects revenue in the range of USD 270 to 300 million. This exceeded analysts’ expectations, which averaged around USD 263 million. By the end of the trading week, Enphase shares were up 35.7 percent at EUR 42.25.

Jinko ESS Receives Top Cybersecurity Certification – Shares Rise Sharply

JinkoSolar announced that its North American business unit, Jinko ESS, has received IEC 62443-2-4 certification from Exida, an internationally recognized authority for industrial cybersecurity. The certification confirms that cybersecurity is embedded from the outset in system design, development, testing, deployment, and lifecycle management. JinkoSolar shares benefited, rising 8.9 percent to EUR 23.30.

Sunrun Expands Flexible Power Supply in the U.S. with Residential Solar Storage

Sunrun, the largest provider of home storage, solar, and home-to-grid systems in the United States, significantly expanded its distributed energy storage capacity in 2025. Customer participation increased by more than fivefold, making Sunrun one of the largest sources of flexible, dispatchable energy in the U.S. In total, nearly 18 gigawatt-hours (GWh) of energy were fed into the grid, with peak output reaching 416 MW. Sunrun shares gained 5.4 percent to EUR 16.84.

Ørsted Realigns the Group

Ørsted is undertaking a comprehensive restructuring of the group and refocusing its strategy on high-growth core markets. The key elements include completing a broad divestment program of European onshore activities, a clear focus on offshore wind energy, and expanding operations in the United States. Ørsted has signed an agreement with Copenhagen Infrastructure Partners (CIP) to sell its entire European onshore business. The transaction volume amounts to EUR 1.44 billion and is expected to close in the second quarter of 2026. Ørsted shares rose 1.2 percent to EUR 19.20.

Scatec and Aboitiz Launch 80 MW Battery Storage at Hydropower Plants in the Philippines

The joint venture SN Aboitiz Power (SNAP), a partnership between Norway’s Scatec ASA and Philippine-based Aboitiz Renewables, Inc., has reached financial close for two battery energy storage system (BESS) projects of 40 MW each and is preparing to begin construction of the Binga (Phase 2) and Ambuklao facilities in the province of Benguet. The storage systems will be directly connected to the existing Binga and Ambuklao hydropower plants and are intended to generate revenue from reserve and balancing energy markets. Scatec shares ended the week largely unchanged, up 0.3 percent at EUR 9.99.

Nordex Shares Reach New Annual High

Nordex continues to secure new orders. In January 2026, the company won several European orders totaling 220 MW, including projects in the United Kingdom, Turkey, and Lithuania. From Sweden’s OX2, Nordex received an order for 189 MW of wind capacity for the Fageråsen wind farm in the Dalarna region. In Germany, Nordex is constructing the Bosbüll Holm Uphusum wind farm (56 MW). Despite these developments, Nordex shares declined 2.1 percent last week to EUR 32.96.

Goldwind – EU Commission Investigates Potential Anti-Competitive Subsidies

The European Commission has launched an in-depth investigation into the Chinese wind turbine manufacturer Goldwind Science & Technology Co., Ltd. The probe follows indications that the company may have received state subsidies from China that could distort competition in the EU internal market. The case is being handled by the Directorate-General for Competition under case number FS.100143. With a decline of 8.9 percent to EUR 1.44, Goldwind shares were among the weakest RENIXX constituents last week.

RENIXX Starts the Week on a Positive Note

At the start of the new trading week, the RENIXX is moving higher. The biggest gainers include Green Plains, Goldwind, Ørsted, Grenergy Renovables, and Cadeler. Decliners include China Longyuan, Vestas, Xinyi Solar, Ormat, and BYD.

left>

About the Global Stock Index RENIXX World

The RENIXX® World (Renewable Energy Industrial Index, ISIN: DE000RENX014) is the world’s first stock index dedicated to renewable energies and the longest-established global market barometer for this industrial future sector. It covers wind energy, solar energy, bioenergy, geothermal energy, hydropower, electromobility, hydrogen, and fuel cells.

The index comprises 30 international companies with the highest free-float market capitalization and reflects both performance and global market developments in the renewable energy industry.

The RENIXX was launched on May 1, 2006, with a base value of 1,000 points; a back-calculation to 2002 has been carried out. The index is available via leading financial media and data providers such as Bloomberg, Reuters, the Financial Times, BlackRock (Aladdin), and Wallstreet Online.

Source: IWR Online, 09 Feb 2026