Stock Market Week 52/25: RENIXX Slightly Lower - Sunrun Strong - Ørsted Falls by Double Digits - Index Heading for a Clear Annual Gain

Münster (Germany) - The RENIXX edged slightly lower during the shortened Christmas trading week. As in the previous week, market activity was dominated by individual stocks showing high volatility, while company-specific news played no decisive role. Ørsted came under pressure following a U.S. government decision to suspend offshore projects.

Technical situation: RENIXX stable between 1,000 and 1,200 points - RENIXX to close 2025 with a gain

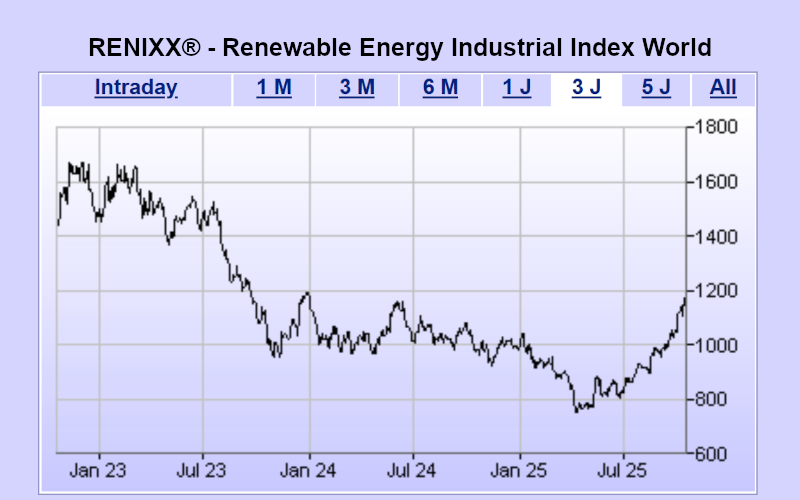

From the end of 2023 to January 2025, the RENIXX moved in a sideways range between 1,000 and 1,200 points. The subsequent drop to 748 points marked a significant intermediate low and continues to form the key support zone in the longer-term chart.

Unchanged from the previous week: amid rising volatility, the index recently climbed to just under 1,300 points, reaching the upper boundary of the former trading range. Profit-taking then pushed the index sharply lower again, at times close to the 1,000-point level. After a rebound and a neutral sideways movement, the RENIXX has declined again over the past two trading weeks. Only a breakout above 1,200 points or a renewed drop below the 1,000-point mark would redefine the overall technical outlook. On a full-year basis for 2025, the RENIXX stands at a gain of 13.4 percent as of Friday’s close (previous week: +14.5%).

Company news Week 52/25

Sunrun delivers year-end rally

The best-performing stock in the RENIXX ahead of Christmas was Sunrun. The share price benefited in part from the multi-year partnership with U.S. utility NRG Energy announced in mid-December, covering a total volume of 1,000 MW (1 GW). Under the cooperation, residential solar and battery storage systems are to be bundled and made available as flexible, dispatchable capacity for the Texas power grid. Through this partnership, Sunrun is evolving from a solar installation company into a provider of virtual power plants. Analysts view the partnership as a strategic step toward recurring revenues and enhanced grid stability, improving the stock’s long-term growth prospects. In addition, a year-end rush to secure federal tax credits for residential solar systems boosted demand. Sunrun shares rose 11.5 percent in pre-Christmas trading to €17.14, resulting in a price gain of more than 80 percent for 2025.

Ørsted shares fall by double digits

The U.S. government caused turbulence in the U.S. offshore wind market last week by suspending lease agreements and construction permits for five offshore wind projects on the East Coast. The U.S. Bureau of Ocean Energy Management (BOEM) is reviewing whether the projects could interfere with radar, military or defense infrastructure. Among those affected by the decision is offshore wind specialist Ørsted, which, due to the BOEM order, must suspend the Revolution Wind and Sunrise Wind projects for an initial period of 90 days, even though both projects are fully permitted and nearly completed. Ørsted is reviewing all options to resolve the matter swiftly together with its partners. This includes engaging with BOEM and other permitting authorities as well as examining possible legal steps to avoid long-term risks to the construction and commissioning of the projects. As a result, Ørsted shares came under heavy pressure last week, plunging a total of 13 percent to €15.56.

RENIXX Starts the Week on a Positive Note

At the start of the final trading week of 2025, the RENIXX rose by 1 percent to 1,123.89 points (closing price, December 29, 2025, Stuttgart Stock Exchange). The biggest gains were recorded by Goldwind, Xpeng, BYD, Green Plains, and Ørsted. On the downside, Canadian Solar, Grenergy Renovables, First Solar, China Longyuan, and Bloom Energy closed lower.

About the global stock index RENIXX World

The RENIXX® World (Renewable Energy Industrial Index, ISIN: DE000RENX014) is the world’s first renewable energy equity index and the oldest global stock market benchmark for this industrial future sector. It covers wind energy, solar energy, bioenergy, geothermal energy, hydropower, electric mobility, hydrogen and fuel cells.

The index comprises 30 international companies with the highest free-float market capitalization and reflects both performance and global market developments in the renewable energy industry.

The RENIXX was launched on May 1, 2006, with a base value of 1,000 points; a back-calculation to 2002 has been carried out. The index is available via leading financial media and data providers such as Bloomberg, Reuters, Financial Times, BlackRock (Aladdin) and Wallstreet Online.

Source: IWR Online, 30 Dec 2025