Stock Market Week 07/26: RENIXX at 1,200 Points - Trump Overturns US Climate Policy Basis - Grenergy Secures $355M Financing - Green Plains Returns to Profitability - Scatec On Track

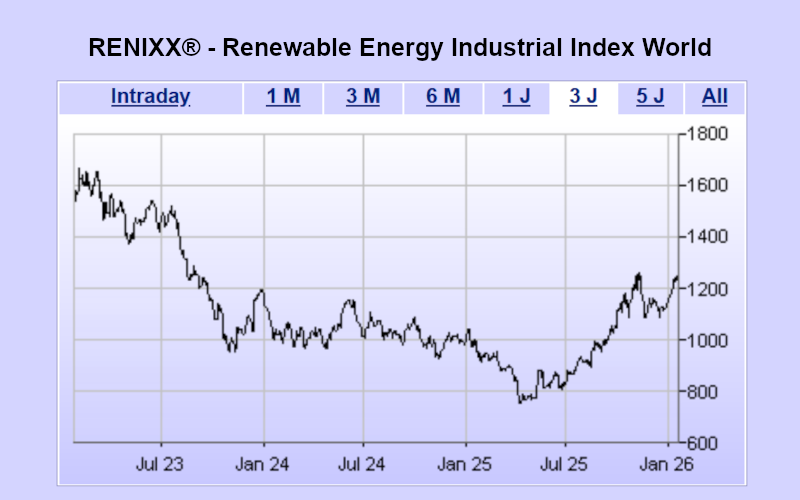

Münster (Germany) - The renewable energy stock index RENIXX World rose slightly last week, closing just above the 1,200-point mark. Some headwinds for “green” stocks were caused by news that the US government plans a realignment of climate policy and intends to repeal existing emissions regulations.

Trump Overturns Key Basis of US Climate Policy - UK Focuses on Renewables

US President Donald Trump on 12 February 2026 repealed the EPA’s “Endangerment Finding,” which had classified greenhouse gases such as CO2 as a threat to health and the climate. This finding had formed the central legal basis for many US climate protection measures. With its repeal, the US further isolates itself, while countries like Saudi Arabia focus on renewable energy domestically and export fossil fuels. Market data indicate that the future lies in electricity-based renewable energy with cost-effective storage: the UK is expanding offshore wind capacity to 40 GW by 2030 while simultaneously shutting down eight old nuclear power plants.

Technical Situation: RENIXX Remains in Sideways Movement with Slightly Positive Trend

From late 2023 to early January 2025, RENIXX traded in a range between 1,000 and 1,200 points. The notable interim low of 748 points in 2025 marked a key turning point and has since acted as a central support zone. From this low, the index has recovered significantly, reaching a yearly high of 1,279.06 points this year, exactly at the top of the previous range. A sustained breakout above this level has not yet occurred. Currently, RENIXX is again in a neutral sideways phase within the larger range, with a slightly positive trend. Support remains in the 1,000-1,100 point range, and resistance lies at 1,280-1,300 points. Year-to-date 2026, RENIXX is up 6.2 % following Friday’s close.

Corporate News Week 07/26

Grenergy Secures $355M Project Financing for Hybrid Solar Projects in Chile

Spanish renewable energy developer Grenergy has secured $355 million in senior non-recourse project financing for its Central-Oasis platform in Chile. The funds will support the development of hybrid solar projects Gran Teno, Tamango, and Planchón, with a total of 398 MW of PV capacity and 1.4 GWh of storage. Grenergy shares rose 10.4 % to €104.00, making it the top RENIXX performer last week.

Cadeler Subsidiary Nexra Wins O&M Contract in Taiwan

Cadeler’s subsidiary Nexra signed a binding operations & maintenance (O&M) contract in Taiwan worth over €20 million. Work begins in March 2026 and is expected to last three to four months, carried out using the Wind Maker installation vessel. Cadeler shares rose 6.5 % to €5.43.

Green Plains Returns to Profitability

Green Plains reported a net profit of $11.9 million (0.17 USD per share) in Q4 2025, with adjusted EBITDA of $49.1 million. For 2026, the company expects adjusted EBITDA of at least $188 million from production tax credits. Shares closed up 6.1 % at €11.43.

Scatec Starts 190 MW Solar Portfolio in Romania

Scatec reached financial close for its 190 MW Dobrun & Sadova solar portfolio and has started construction. Approximately 70 % of expected output is secured by 15-year contracts-for-difference (CfD); the rest will be sold on the Romanian wholesale market. Shares rose 1.7 % to €10.16.

Vestas Buyback Continues - 570,000 Shares Repurchased in First Week

As part of its buyback program announced on 5 February 2026, Vestas repurchased 570,000 shares in the first week. The program runs until 5 May 2026 with a maximum volume of 1.12 billion DKK (~€150 million). Prior to the program, Vestas held 1.9 % of its share capital. Shares fell 7.7 % to €20.51.

RENIXX Starts the Week Slightly Up

At the start of the new week, RENIXX shows modest gains. Early winners include Meridian Energy, Nordex, First Solar, Vestas, and Bloom Energy; losers include Verbund, China Longyuan, Erg S.P.A., EDP Renewables, and Canadian Solar.

About the Global Stock Index RENIXX World

The RENIXX® World (Renewable Energy Industrial Index, ISIN: DE000RENX014) is the world’s first stock index dedicated to renewable energies and the longest-established global market barometer for this industrial future sector. It covers wind energy, solar energy, bioenergy, geothermal energy, hydropower, electromobility, hydrogen, and fuel cells.

The index comprises 30 international companies with the highest free-float market capitalization and reflects both performance and global market developments in the renewable energy industry.

The RENIXX was launched on May 1, 2006, with a base value of 1,000 points; a back-calculation to 2002 has been carried out. The index is available via leading financial media and data providers such as Bloomberg, Reuters, the Financial Times, BlackRock (Aladdin), and Wallstreet Online.

Source: IWR Online, 16 Feb 2026