Stock Market Week 05/26: RENIXX Reaches Yearly High - U.S. Solar Stocks Under Pressure - Ørsted Welcomes Offshore Wind Pact - Scatec: Revenue Growth - Solaredge: Bifacial PV System For Ski Resorts

Münster (Germany) - The RENIXX declined slightly last week but remains stable above the 1,200-point mark. U.S. solar stocks were in focus, with some suffering significant losses. In addition to competitive concerns, Tesla’s announcement of plans for its own solar production is likely to have dampened demand expectations.

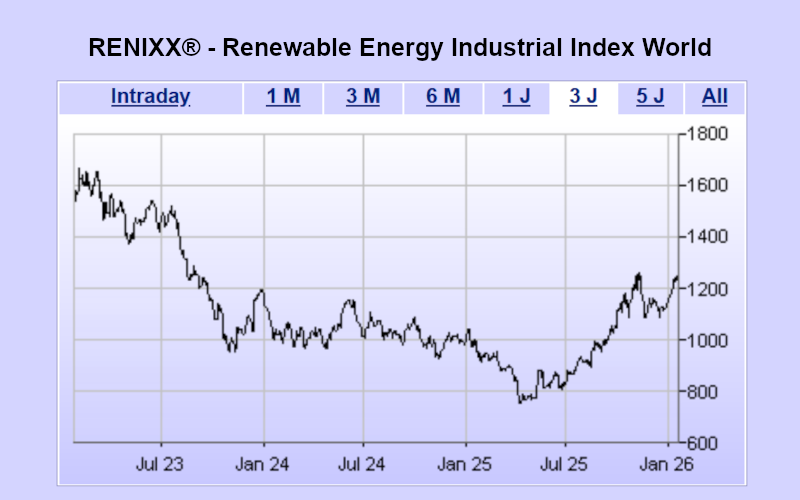

Technical situation: RENIXX reaches new yearly high

From the end of 2023 to early January 2025, the RENIXX moved sideways within a range between 1,000 and 1,200 points. The drop to 748 points in 2025 marked a pronounced intermediate low and an important turning point that now serves as a key support zone. Since then, the RENIXX has recovered steadily and reached a new yearly high of 1,279.06 points last week - the upper boundary of the former trading range. As the index was unable to hold this level, it slipped back into a neutral sideways phase but continues to show a slightly positive trend. On a year-to-date basis for 2026, the RENIXX is up 8.2 percent based on Friday’s closing price.

Successful North Sea Summit: Ørsted welcomes offshore wind pact as a milestone for Europe’s energy supply

Last week, the North Sea Summit 2026 took place in Hamburg at the invitation of Federal Chancellor Friedrich Merz and Federal Minister for Economic Affairs Katherina Reiche. Ørsted welcomed the “Joint Offshore Wind Investment Pact for the North Seas,” signed during the summit, as a key milestone for the European energy transition. The pact, agreed upon by governments together with the wind industry and transmission system operators (TSOs), is intended to significantly accelerate the expansion of offshore wind capacity in the North Sea. Ørsted benefits from the plans for European offshore wind expansion, with the share price rising by 4.2 percent to €18.97.

Scatec reports revenue growth - power production declines after asset sales - share price falls

Norwegian project developer Scatec continued to expand its growth momentum in the fourth quarter of 2025. Proportionate revenues increased by 25 percent to NOK 3,362 million (approx. €294 million), up from NOK 2,684 million (approx. €235 million) in the same quarter of the previous year. EBITDA declined to NOK 1,065 million (approx. €93.1 million) (Q4 2024: NOK 1,375 million / approx. €120 million). For the full year, Scatec reported proportionate revenues of NOK 11,002 million (approx. €962 million) (2024: NOK 7,853 million / approx. €687 million) and EBITDA of NOK 4,635 million (approx. €405 million) (2024: NOK 4,694 million / approx. €410 million). Scatec also announced that it has been awarded a 25-year power purchase agreement (PPA) with the Tunisian state utility STEG for a 120 MW solar power plant in Tataouine. The PPA was awarded through a government tender and is intended to support Tunisia’s renewable energy expansion and energy security. Scatec shares fell by 4.4 percent last week to €9.96.

Solaredge and Helioplant cooperate: bifacial PV system for alpine ski resorts

Solaredge and Helioplant are combining their technologies to establish photovoltaic systems on a larger scale in high alpine regions. A bifacial PV system with a cross-shaped support structure is designed to deliver stable yields even under extreme weather conditions and to open up new market opportunities in ski resorts. At the core of the cooperation between RENIXX constituent Solaredge and Helioplant is a novel PV design for mountainous regions that addresses snow drifts, shading, and the high construction costs of conventional systems. A 6.3 MWp system in Sölden serves as a reference project and is expected to cover around one third of the electricity demand of several ski resorts in the future. Solaredge shares came under pressure, falling by 10.9 percent to €26.09.

Plug Power installs 100 MW electrolyzers at Galp in Sines - green hydrogen for Europe’s refineries

Plug Power has completed the installation of PEM GenEco electrolyzers with a total capacity of 100 MW at the Sines refinery of Portuguese energy group Galp. The project is one of the largest renewable hydrogen initiatives in Europe and marks an important step toward reducing CO₂ emissions in the refinery industry. According to Plug Power, all ten electrolyzer arrays, each with a capacity of ten megawatts, have been delivered to and installed at the site since the project was announced in October 2025. Commissioning is expected to begin in the coming months. In regular operation, the systems are expected to produce up to 15,000 tons of renewable hydrogen per year, potentially replacing around 20 percent of the refinery’s previous use of grey hydrogen. With a steep loss of 14.4 percent to €1.79, Plug Power shares were among the weakest performers last week.

RENIXX starts weaker

In early trading in the new week, the RENIXX is in negative territory. With the exception of the two wind stocks Vestas and Nordex, all other shares are posting losses. The largest price declines are seen in Daqo, BYD, Xpeng, Goldwind, and Ballard Power.

About the global stock index RENIXX World

The RENIXX® World (Renewable Energy Industrial Index, ISIN: DE000RENX014) is the world’s first stock index for renewable energies and the oldest global stock market benchmark for this industrial future sector. It covers wind energy, solar energy, bioenergy, geothermal energy, hydropower, electromobility, hydrogen, and fuel cells.

The index comprises 30 international companies with the highest free-float market capitalization and reflects both the performance and the global market development of the renewable energy industry. The RENIXX was launched on May 1, 2006, with a base value of 1,000 points; a back-calculation to 2002 was carried out. The index is available via leading financial media and data providers such as Bloomberg, Reuters, Financial Times, BlackRock (Aladdin), and Wallstreet Online.

Source: IWR Online, 02 Feb 2026